Establishing a secure financial infrastructure can be daunting, but it doesn’t have to be.

With just a few development tasks and a specialized Fintech team, you can get your finances up and running. Our experienced professionals know the ins and outs of data security, so you don’t have to worry about potential breaches or lost assets. No matter your Fintech roadmap, our team is here to guide you towards success in creating the perfect financial infrastructure for both now and the future.

Our library of web components cover the complete customer journey from customer onboarding to product integrations such as insurance or lending offers.

Because each component is supported with elegant KYC data mapping, transaction data is automatically synchronized without sacrificing data integrity; user-friendly interfaces and a dev-friendly API simplify the setup process for any platform.

Avoid manual processes of aggregating and reconciling transaction data across multiple partners or facilitators.

JustiFi unites all your integrated transaction data into one centralized dashboard that features intelligent reconciliation tools for easy analysis, better business reporting and performance optimization.

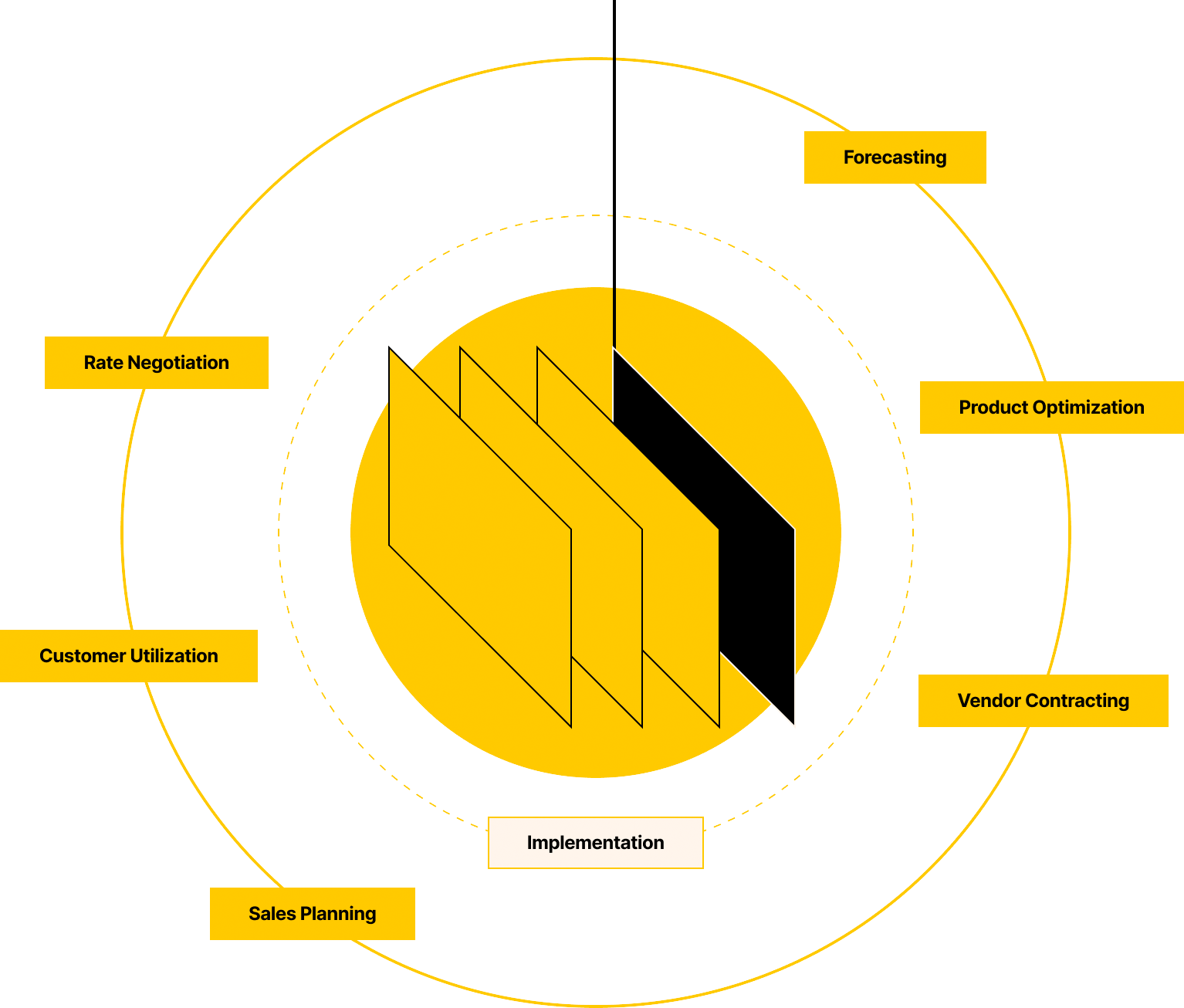

Navigating financial partners, and managing customer utilization can be daunting without internal expertise.

So we give you a full-team to handle the hard stuff as a part of the platform. Led by a Chief Fintech Officer, JustiFi Engage™ is a tech-enabled resource for your Fintech go-to-market product strategy, feature utilization, forecasting, fundraising, and everything in between.

As more and more businesses get involved in the Fintech industry, managing customer financial data is essential to both launch and monetize new products.

The JustiFi customer onboarding component provides the fastest way to own your data while still protecting against compliance risk. Not only that, with it you can quickly understand how much of your current customers are eligible for integrated fintech solutions like insurance payouts, lending options or instant payouts – ensuring you don’t miss any important opportunities. Through its secure data protocols, JustiFi makes sure that your financial data remains safe from any potential cyber threats.

Our hosted onboarding solution is the ideal way to streamline customer account creation and reduce manual data entry. With just one simple integration via our Fintech API, you can quickly embed our powerful data capture tools in your existing environment.

Our data vault offers a powerful, secure way to track, store and dynamically update important financial information while keeping it compliant with all applicable laws and regulations. Our Fintech API allows customers easy access to their data and transaction history anytime they need it, making it simple to keep records up-to-date so their financial systems stay Fintech ready in any situation.

JustiFi’s hosted onboarding provides you with an easy-to-implement, user-friendly way to collect the required business and financial information from each sub accounts within your platform.

const handleOnboardingCompletion = (e) => {

const { eventType } = e.data;

if (eventType === 'submitSuccess') {

// Handle successful onboarding

}

if (eventType === 'submitFailure') {

// Handle failed onboarding

}

};

window.addEventListener('message', handleOnboardingCompletion);

JustiFi provides a hosted checkout solution which allows you to collect a payment via a checkout form which we host. This solution requires less frontend integration work on your platform.

With JustiFi, you can easily view fees, refunds, and balance transactions on a per-payment basis, providing businesses with total visibility into their operations. The utilization dashboard provides an overview of features being used by customers so that businesses can understand which Fintech solutions are best suited for them. With JustiFi, businesses can make the transition to Fintech-readiness with confidence and ease.

JustiFi GL is a platform General Ledger that makes payments transparency easy.

With it, businesses can easily view fees, refunds, balance transactions on a per-payment basis, allowing them to understand the financial flow of their operations. The utilization dashboard provides an overview of customer interactions so that businesses can assess which Fintech solutions are most relevant for them. As a result, companies can transition to greater Fintech-readiness with confidence and assurance.

Beyond that, JustiFi employs powerful data tokenization techniques during transmission from the different layers of sub accounts; these ensure secure delivery of encrypted data across platforms.

By delivering end-to-end solutions tailored to any size business from SMEs to major corporations, JustiFi GL takes away the hassle associated with payments processes in order to maximize security and efficiency.

const resp = await fetch(

`https://api.justifi.ai/v1/payments`,

{

method: 'POST',

headers: {

'Content-Type': 'application/json',

'Idempotency-Key': '497f6eca-6276-4993-bfeb-53cbbbba6f08',

Authorization: 'string',

'Sub-Account': 'string',

'Seller-Account': 'string'

},

body: JSON.stringify({

amount: 1000,

currency: 'usd',

capture_strategy: 'automatic',

email: 'example@test.com',

description: 'Charging $10 to the test card',

payment_method: {

card: {

name: 'Ashley Johnson',

number: '4111111111111111',

verification: '123',

month: '3',

year: '2040',

address_postal_code: '55555'

}

}

})

}

);

const data = await resp.json();

console.log(data);

Avoid vendor lock-in. Our infrastructure provides the tools to integrate multiple finance products within a seamless customer experience.

JustiFi allows you to turn on fintech products for your users in less than a week through our fintech orchestration. With our flexible infrastructure and tech-enabled services, you can quickly and easily add value to your platform and provide your customers with the fintech tools they need to grow.

Data tokenization keeps customer data safe, secure, and compliant with industry standards such as PCI-DSS Level 1, SOC 2, ISO 27701 and ISO 27001.

This infrastructure works seamlessly with your system to unite vendor solutions while you remain in control of customer experience and economics. Our system also provides a secure compliance engine to ensure all data transfers and payment information is safely managed, on top of affording you full ownership over your data which gives you the power to set the rules.

Activate your platform into a fintech powerhouse with the ability to seamlessly integrate multiple fintech solutions into every customer.

const resp = await fetch(

`https://api.justifi.ai/v1/insurance/bind`,

{

method: 'POST',

headers: {

'Content-Type': 'application/json',

Authorization: 'string'

},

body: JSON.stringify({

payment_method_id: 'pm_123',

amount: 10000,

currency: 'usd',

partner_quote_id: 'ins-test-123',

partner_name: 'insure co',

metadata: {}

})

}

);

const data = await resp.json();

console.log(data);

Fintech represents a massive revenue opportunity for vertical SaaS platforms. Your team needs a central location to access financial reporting, forecasting tools, and a direct line of communication with our integration team. The Engage Fintech Dashboard has you covered.

Experts in the payments and fintech space are hard to find and expensive.

We provide you with a team led by our Chief Payments Officer to consult on go-to-market product strategy, feature utilization, forecasting, fundraising, and everything in between.

We’ll give you the framework to create competitive sales compensation plans, messaging + positioning, and internal educational materials to turn fintech into a revenue engine for your business.

The Fintech Platform for Platforms