Finally, a fully white-label, multi-product infrastructure for companies ready to accelerate their fintech potential. One simple SaaS fee, full pass through economics.

After building SaaS platforms for 15 years, we’ve created what we wish we had – a full stack of white-label fintech tools that allow you to keep the lion’s share of revenue from the funds flowing through your platform.

JustiFi unlocks new:

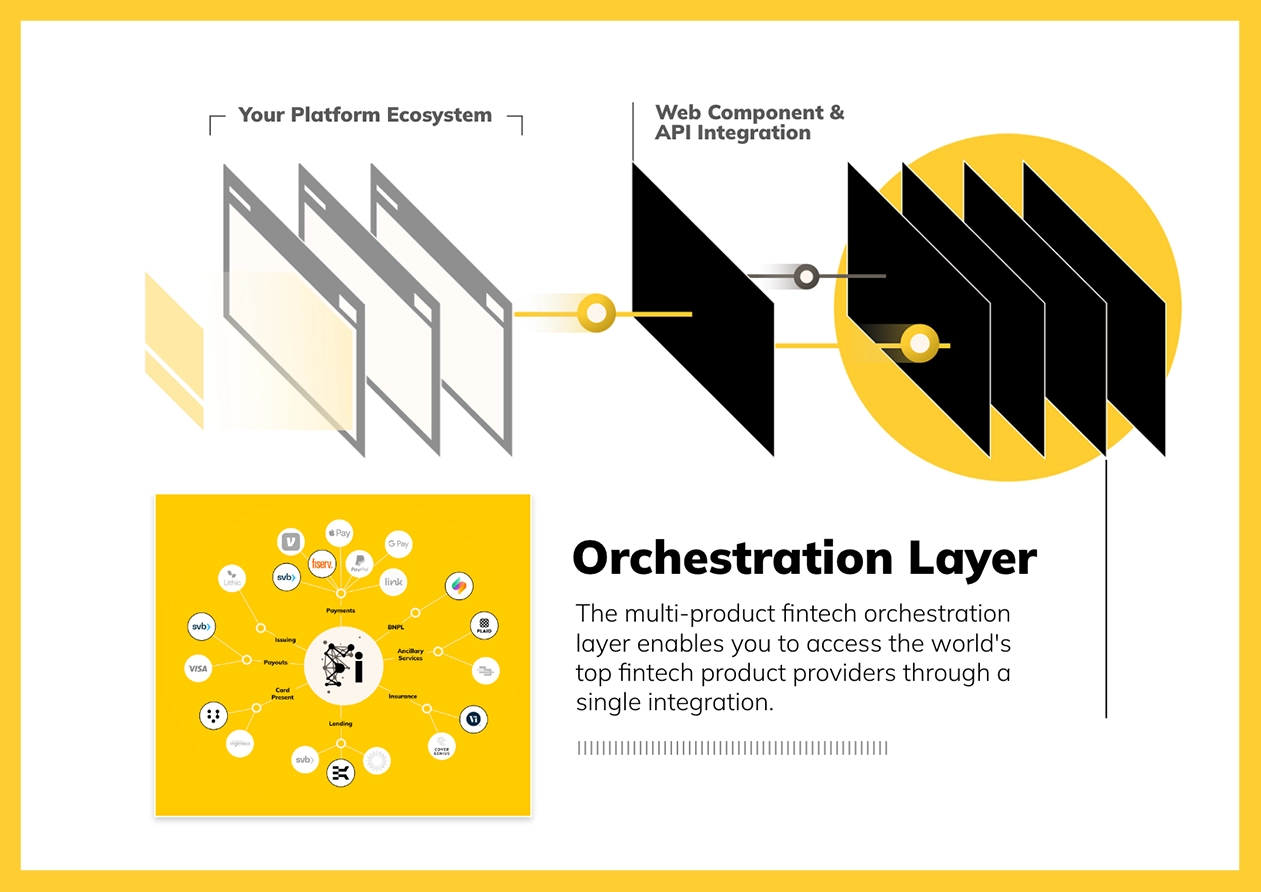

JustiFi’s fintech infrastructure includes everything platforms need for payments, all with PayFac Direct™ Pricing—100% pass-through of sponsor bank schedule A pricing.

Monetize Integrated checkout insurance and warranties from our growing list or customize your own product and launch with a single toggle.

Toggle on and monetize Buy Now, Pay Later instantly with JustiFi’s Unified Fintech Checkout.

Monetize business and consumer lending making your platform stickier while enhancing your overall fintech keep.

World-Class

Everything we build is designed specifically to optimize monetization for platforms.

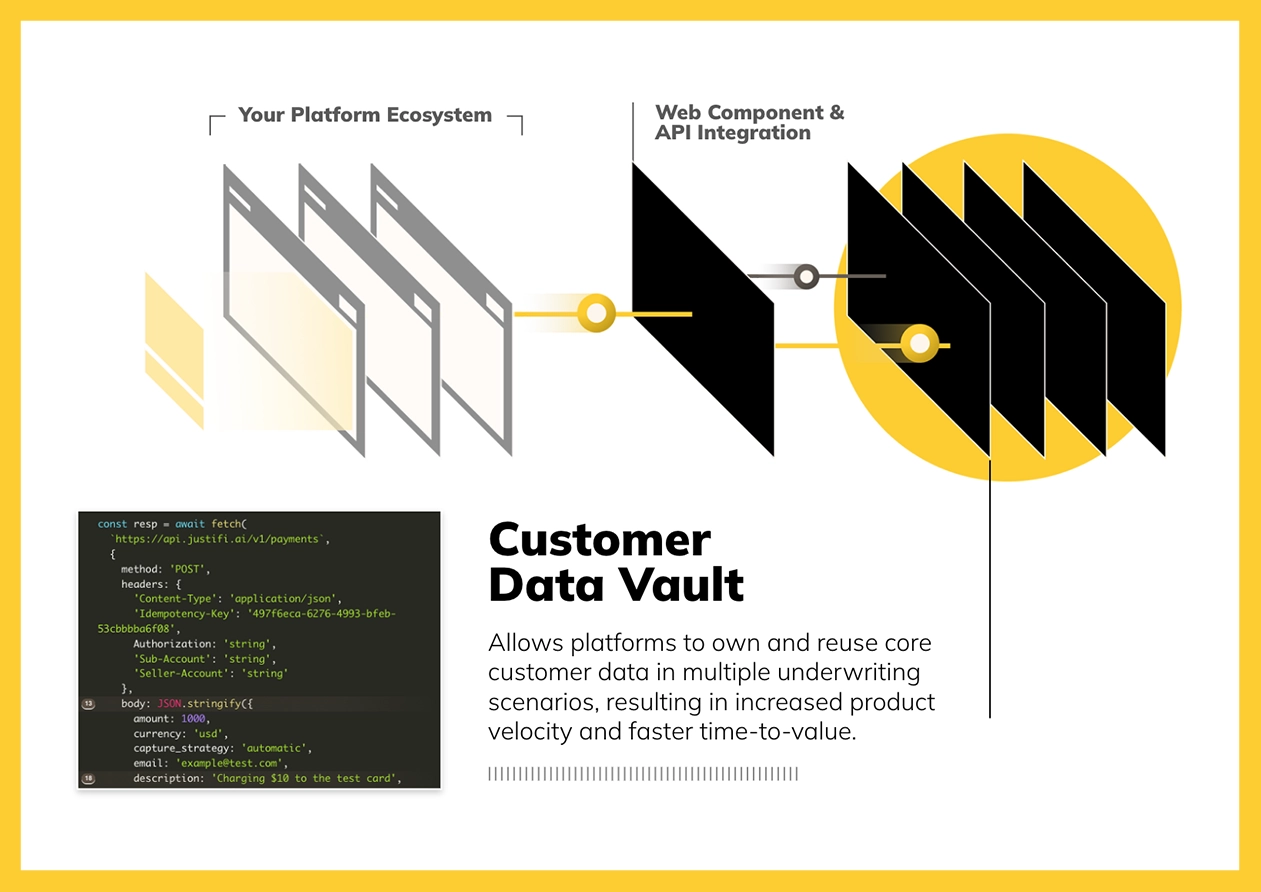

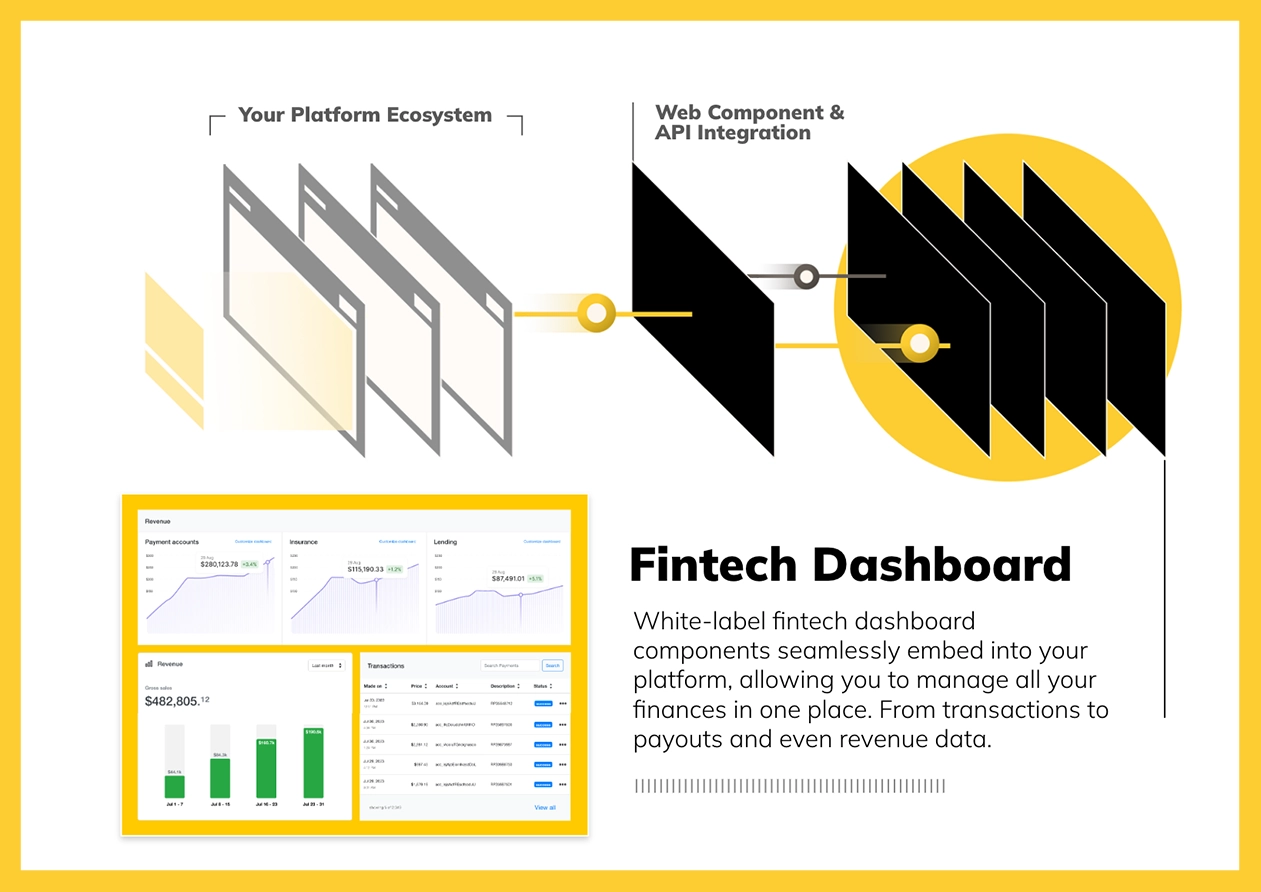

Every fintech product is white-labeled, and easily integrated via our low-code API or web components. This means accelerated fintech revenue growth for your platform, and essential fintech solutions, like lending and insurance, for your customers’ end users.

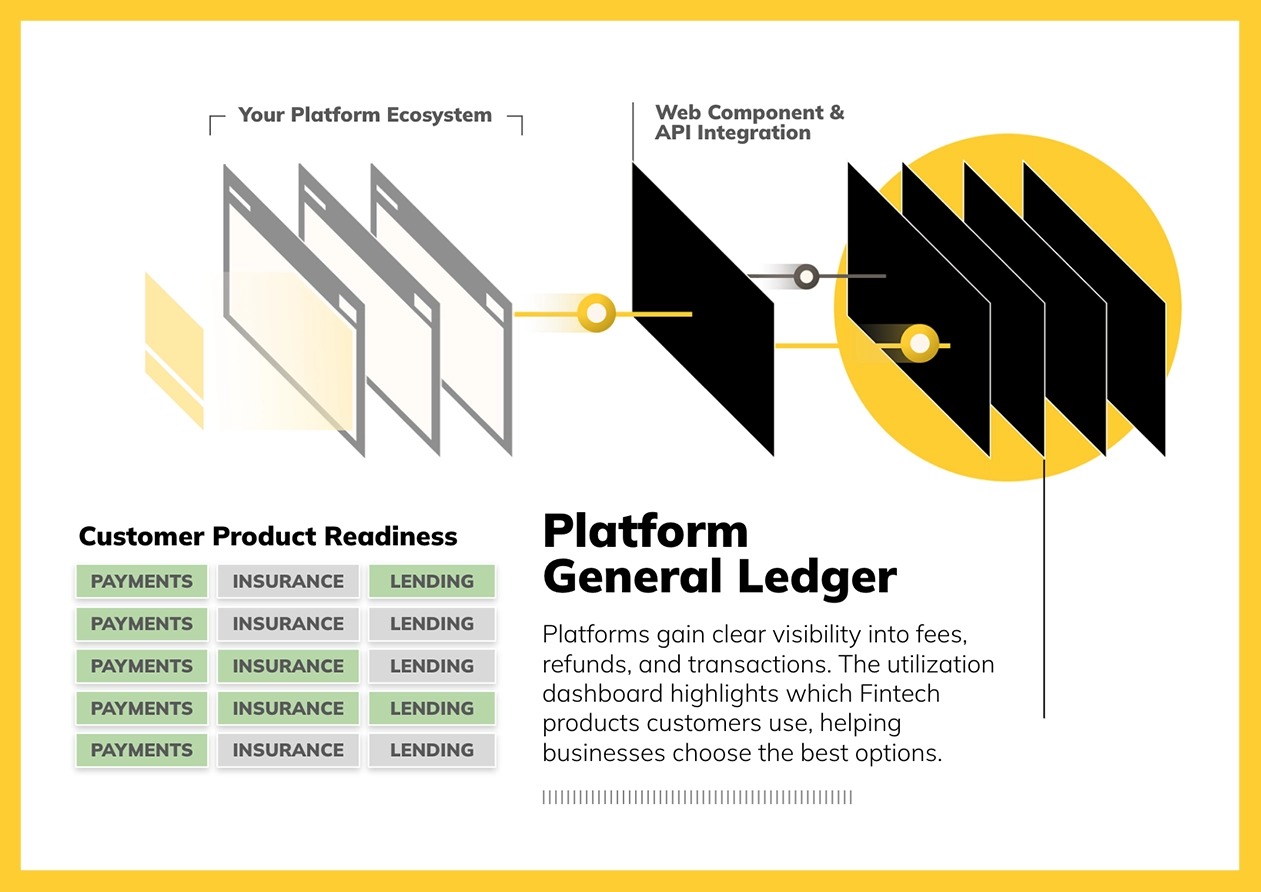

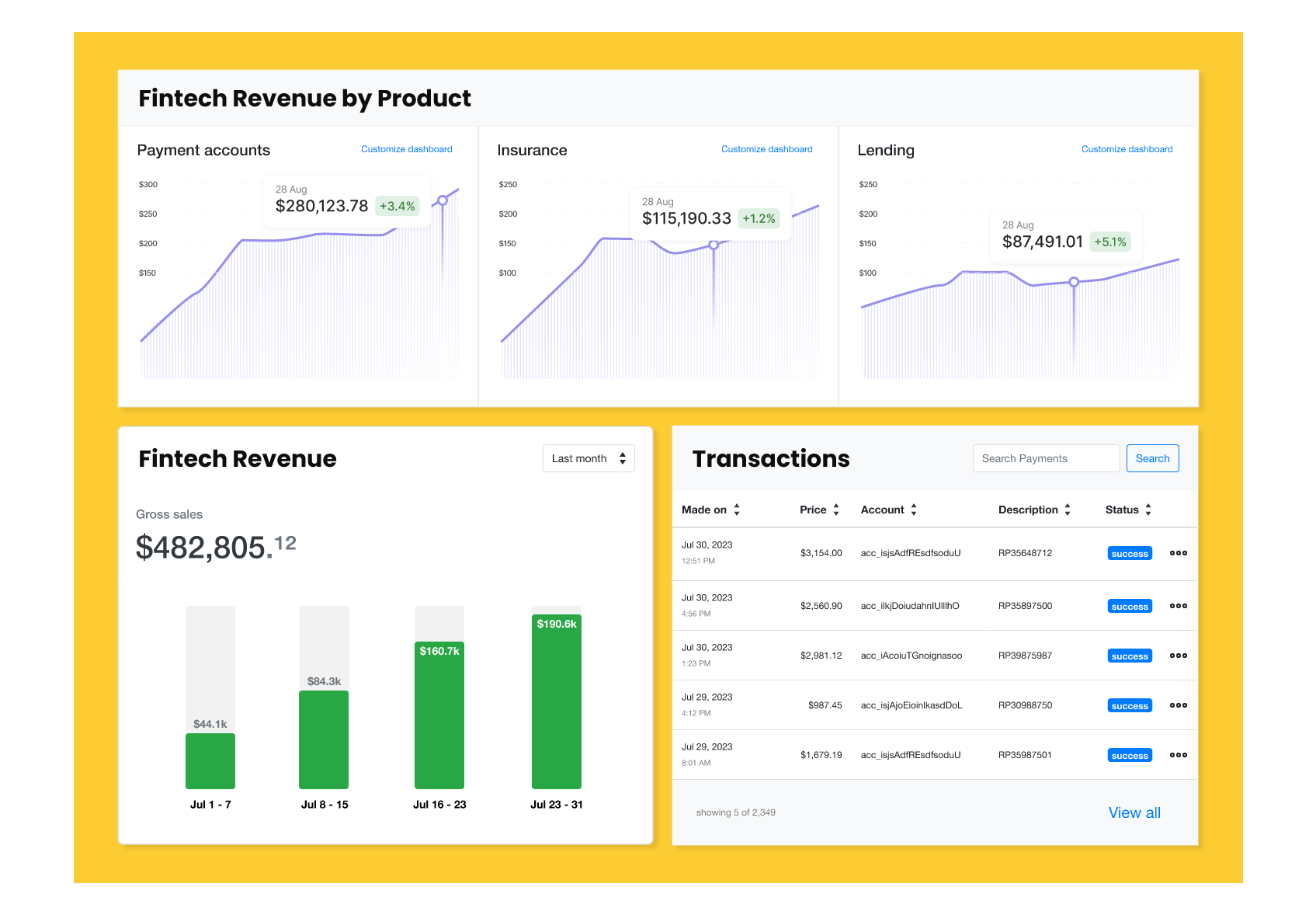

All fintech products in one dashboard: payments, insurance, lending & BNPL.

Use the JustiFi hosted onboarding solution to start collecting and storing customer data.

View the fintech-readiness of your customers and activate the products they need, from payments to lending and insurance.

Earn additional revenue from each fintech product, growing the value of your business and as you deliver more value to customers.

The Fintech Platform for Platforms