Offering easy-to-use lending options directly from your platform accelerates growth and creates new revenue streams. However, choosing the right solution can be daunting. Our team and infrastructure provide tailored embedded finance solutions that add value to both your customers and theirs.

White label from day one. Your platform and your brand are front and center with everything we do.

The days of waiting to achieve meaningful monetization or needing a “custom” integration are over.

Be world-class from day one.

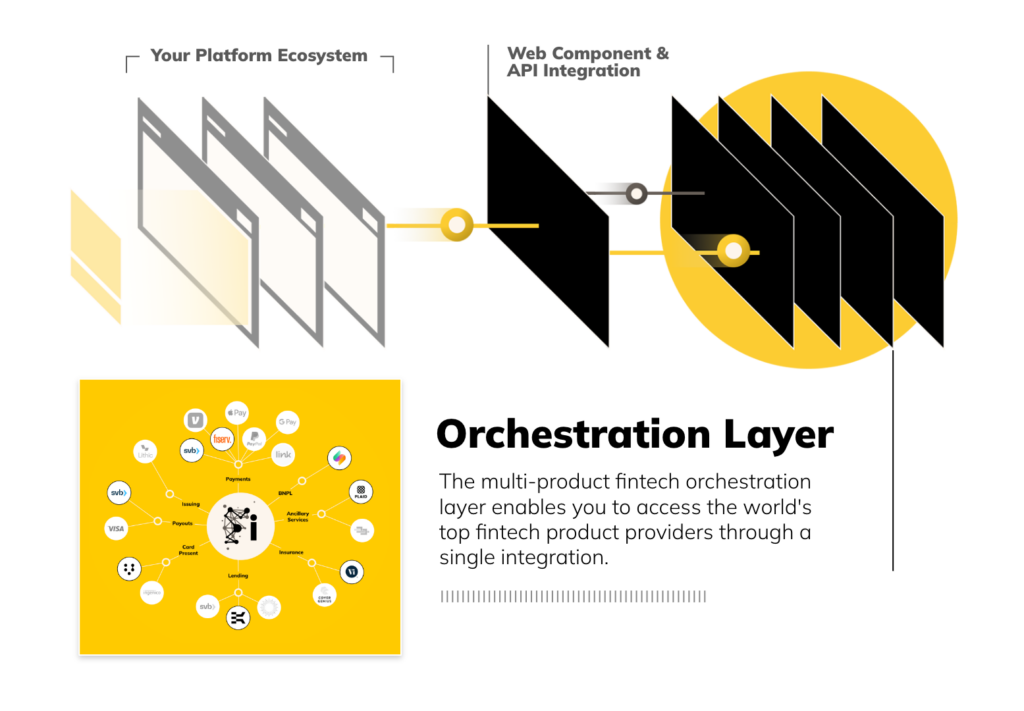

Embedded finance offers platforms new opportunities to support their ecosystems of businesses and consumers while boosting platform stickiness, improving workflows, and increasing revenue. With JustiFi’s orchestration layer in its Fintech Infrastructure, monetizing credit products has never been easier.

Contact us today — we’re constantly evaluating future partners and products.

The Fintech Platform for Platforms