Insurance is a complex category, making it tough for platform teams to find the right partner and product, let alone model ROI. JustiFi simplifies this by integrating the right partner and product, often directly into our Unified Fintech Checkout™, to deliver real-time, contextual insurance offers that benefit end consumers, platform customers (SMBs), and your platform.

Consumers are protecting all types of purchases today, from travel and event tickets to pet insurance and youth sports. The key, of course, is to provide the contextual offers at the right time to increase adoption and thus stickiness and fintech monetization for your platform.

Provides up to a 100% reimbursement if the event host or planner is forced to cancel the event due to unforeseen circumstances.

Protects event hosts, planners, and venues from the financial risks associated with property damage, accidents, or injuries that may occur during the event.

Reimburses up to $5,000 of out-of-pocket medical costs resulting from an accident or an injury that occurs during a covered activity.

Refunds all or part of annual or recurring membership fees if the member is forced to pause their membership due to unforeseen circumstances.

Two types of affordable pet insurance with low deductibles and monthly premiums to cover cats and dogs of all ages and breeds.

Reimburses up to 100% of registration fees if the participant is forced to withdraw due to unforeseen circumstances.

Covers damages to the apartment and protects the renter and their personal belongings if the unexpected happens.

Reimburses sellers for items that are lost, stolen, or damaged in transit.

Provides a 100% refund for the cost of the tickets (including fees) if the ticket holder is unable to attend unexpectedly.

Offers up to a 100% reimbursement for tuition payments and room and board costs if the student is unable to complete the semester due to an illness, injury, or other medical reason.

Reimburses up to 100% of trip costs and related expenses if the travelers are forced to cancel or if the trip is interrupted.

Protects travelers from the financial implications resulting from accidental damage to the rental property.

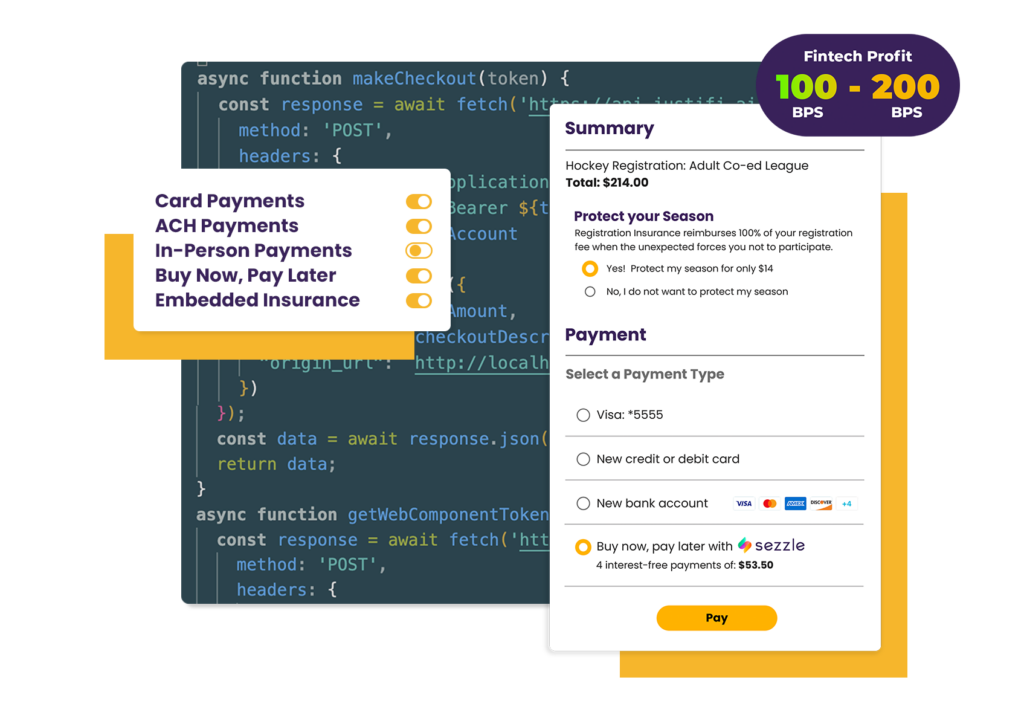

Your platform offers many opportunities for monetization, but few are as powerful as the checkout. With JustiFi’s Unified Fintech Checkout™ (UFC), you can launch multiple products with a toggle and customize checkout settings for different users and scenarios.

You want a fully embedded insurance solution with world-class economics, right?

With JustiFi’s fintech infrastructure you get fully embedded, monetized insurance products with a toggle.

The Fintech Platform for Platforms