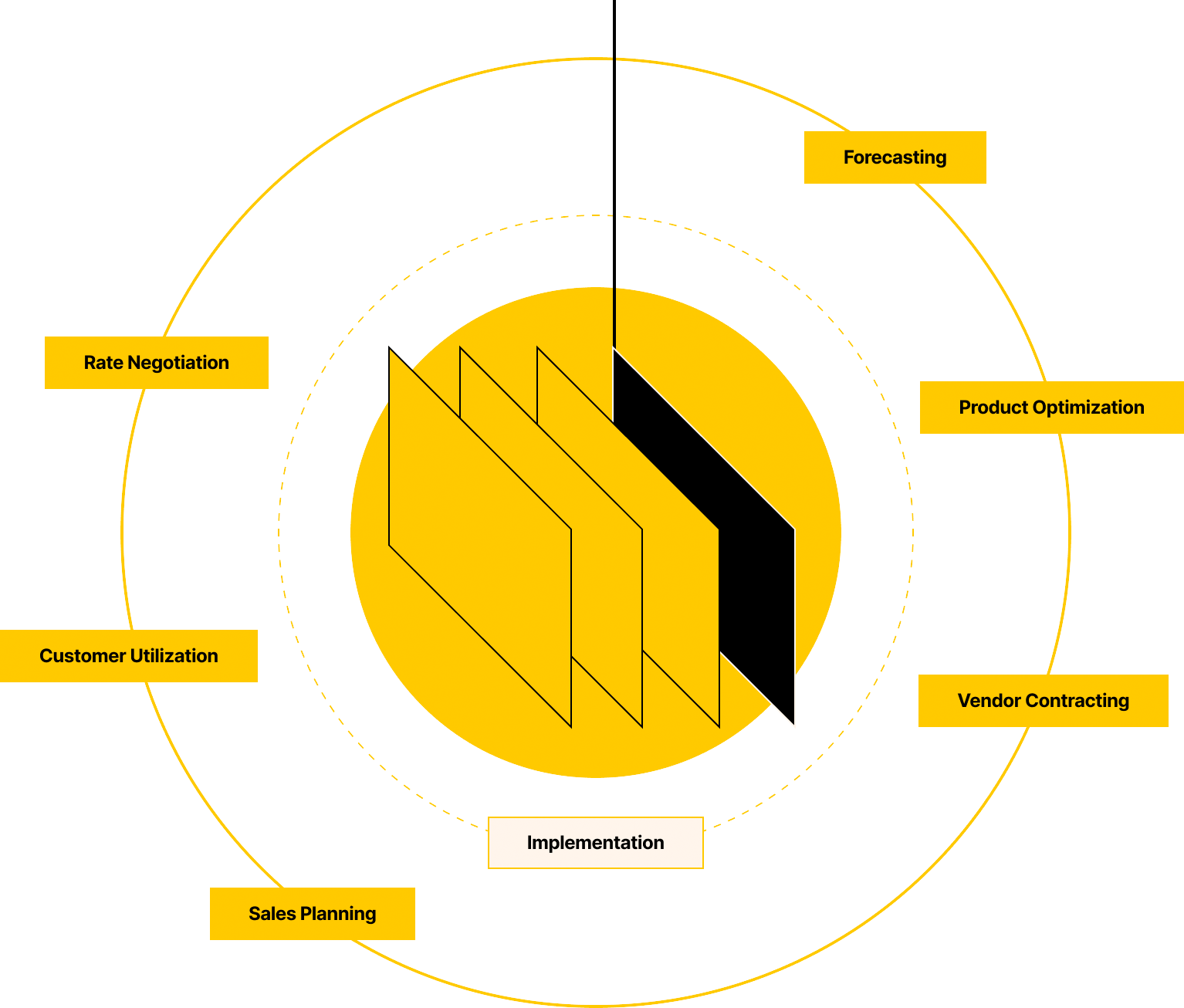

Experts in the payments and fintech space are hard to find and expensive. As part of our platform, we provide you with a team led by a Chief Fintech Officer to consult on go-to-market product strategy, feature utilization, forecasting, fundraising, and everything in between.

Engage™ is a hands-on approach to deliver the optimal blend of go-to-market strategy, forecasting, and fintech product utilization that you won’t get from hiring an internal team who “used to work in payments”.

If less than 100% of your customers utilize your platform’s fintech features, there is money sitting on the table. We’ll give you the framework to create competitive sales compensation plans, messaging + positioning, and internal educational materials to turn fintech into a revenue engine for your business.

Included in your JustiFi infrastructure is a central location to access financial reporting, forecasting tools, and a direct line of communication with our integration team. The Engage Fintech Dashboard has you covered.

JustiFi Engage specializes in removing the hassle associated with all aspects of product management and embedded finance operations. We understand the complexities of fintech, from scaling lending options to integrating insurance solutions, so that you can hone in on what matters most – making sure your platform is running smoothly, with optimized economics and an impeccable customer experience. Forget about spending countless hours researching vendors and sorting through tedious paperwork – with JustiFi Engage, you can trust our experienced professionals to bring you the best solutions for your unique product needs.

Integrate customer onboarding

Integrate web components based on the data gaps

Sign with recommended vendor/provider

Identify data-gaps based on provider needs

Build-out customer onboarding

Ongoing customer data collection

Data compliance & reporting

Find & aggregate legacy data from payment vendors

Forecast the risk/value of different fintech opportunities

Evaluate different vendors/providers

Negotiate pricing with different vendors/providers

Tokenized data sharing as you move between vendor contracts

Contracting with chosen provider/underwriter

Sales training around industry compliance

Create GTM language for customers

Create web components for new products

Support UX over time

Renegotiate terms with providers over time

The Fintech Platform for Platforms