How Leap partners with JustiFi to help their customers streamline payments and close more deals.

About Leap

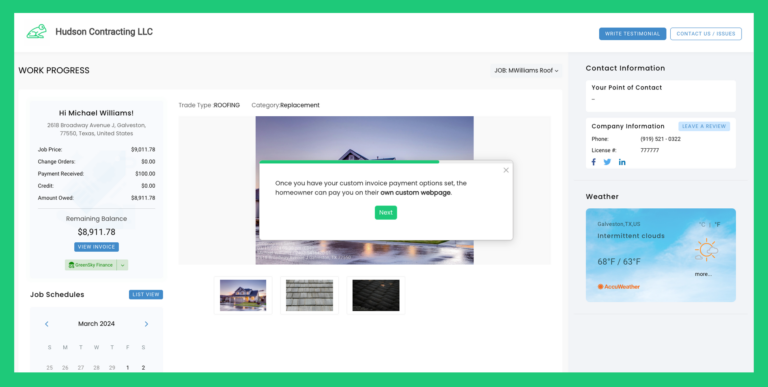

Leap is the leading roofing and remodeling estimate software, designed by industry experts to manage every stage of a job from inspection to final payment. Previously, Leap relied on multiple payment processors. Partnering with JustiFi, they created LeapPay, a fully embedded payment solution that empowers businesses to seamlessly accept payments from homeowners and close more deals.

Problems to be Solved

Leap listened closely to their customers and identified several pain points with their traditional payment processors:

- Slow Payment Processing: Traditional payment methods led to delays, with businesses waiting for checks to clear and having to chase down late payments.

- Cash Flow Management: Delayed payments affected contractors’ cash flow.

- Manual Data Entry: Managing multiple payment methods was time-consuming and error-prone.

- Limited Payment Options: Customers demanded credit cards, ACH, and Buy Now, Pay Later (BNPL) options.

Solution

Leap collaborated with JustiFi to address these issues:

- Effortless Integration: LeapPay works seamlessly within Leap, eliminating the need for separate payment systems.

- Faster Payments: Secure, instant electronic payments provide faster access to funds.

- Improved Cash Flow: Faster access to funds ensures healthier cash flow.

- Streamlined Workflows: Automated payment reconciliation reduces manual data entry and errors.

- Enhanced Customer Experience: Secure online payment options (credit cards, ACH, BNPL) improve satisfaction and help customers close deals faster.

"JustiFi's capabilities have enabled us to create an amazing embedded experience for our customers. Contractors using LeapPay are more satisfied and close more deals than those using traditional processors.”

Craig Jones, Head of Fintech @ Leap

- Enhanced Security: LeapPay benefits from JustiFi’s PCI-DSS and SOC 2 compliance, ensuring the highest standards for data security.

- Reduced Administrative Burden: Managing multiple payment methods is simplified, freeing up time for core activities.

Check out an interactive demo of LeapPay

Customer Activation

Although customers had significant issues with their traditional processors, Leap knew migrating the entire Leap CRM customer base to LeapPay would be time consuming. JustiFi partnered with Jones, and the Leap team, to devise a comprehensive go-to-market strategy. Using this playbook, Leap scaled from $0 to an annualized monthly payment volume of tens of millions of dollars in less than six months. With several billion in potential payments across Leap’s growing customer base, the future looks extremely bright.

Conclusion

JustiFi’s partnership with Leap has significantly improved payment processing, enhancing operational efficiency and customer satisfaction. Leap’s customers are closing more deals thanks to the seamless payment experience provided by LeapPay. Looking ahead, Leap plans to continue collaborating with JustiFi to activate more of their customer base and explore new revenue-generating fintech products, such as embedded insurance and Buy Now, Pay Later.