Understanding Interchange Rates for Vertical SaaS Platforms

Interchange and network fees play a major role in payment processing costs, still very few business leaders know how these fees actually work. If you operate a vertical Software as a Service (SaaS) platform, understanding interchange and network fees is vital for managing costs, setting price and optimizing your payment processing revenue.

Let’s delve into what interchange rates are, how they’re determined, and why they matter, especially for vertical SaaS platforms.

What Exactly Are Interchange Rates?

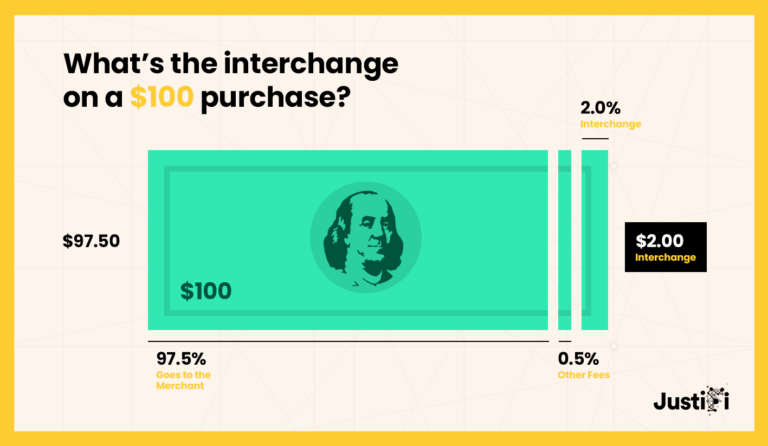

Interchange rates, also known as interchange fees, are charges imposed by banks that issue debit or credit cards for facilitating transactions. These fees, set by major credit card networks like Visa, Mastercard, Discover, and American Express, typically represent a percentage of the transaction value. They’re designed to cover operational costs and mitigate the financial risk associated with electronic payments.

The Mathematics Behind Interchange

Interchange rates aren’t arbitrary; they’re meticulously calculated based on a variety of factors. Different types of cards, transaction methods, and even the nature of the business influence these rates. For instance, debit cards generally incur lower interchange fees, while premium rewards credit cards command higher fees to cover the cost of those rewards programs.

What Determines Interchange Rates?

Numerous factors influence interchange rates, shaping the complex fee structure of payment processing. Here are some key determinants:

Debit vs. Credit Card:

Debit cards typically carry lower interchange fees compared to credit cards due to a number of factors.

Standard vs. Rewards Card:

Premium rewards credit cards often incur higher interchange fees, as a portion of these fees is allocated to cover the costs of rewards programs.

In-Person vs. Online Transactions:

Transactions conducted in person, such as chip or swipe transactions, generally have lower interchange fees due to the reduced risk of fraud. Conversely, online transactions or those conducted via phone (keyed-in transactions) often incur higher interchange fees due to the increased risk associated with card-not-present transactions.

Type of Business:

The merchant category code (MCC) assigned to a business by their payment processor can also influence interchange rates. Different industries may have varying levels of risk associated with transactions, impacting the interchange fees applied to them.

Understanding your Effective Rate

While interchange rates are a critical component of your overall payment processing costs, they are just one piece of the puzzle. Your total effective rate encompasses interchange fees along with network and processor fees. Understanding your effective rate is essential for vertical SaaS platforms to understand their true cost of payment processing.

Learn how to optimize your effective rate.

Navigating the Interchange Landscape

Understanding interchange rates is crucial for vertical SaaS platforms to manage costs effectively. However, it’s essential to remember that these rates are just a part of your total effective rate, which also includes network and processor fees. By comprehending both interchange rates and your effective rate, you can make informed decisions to reduce processing fees and accelerate your payment monetization potential.